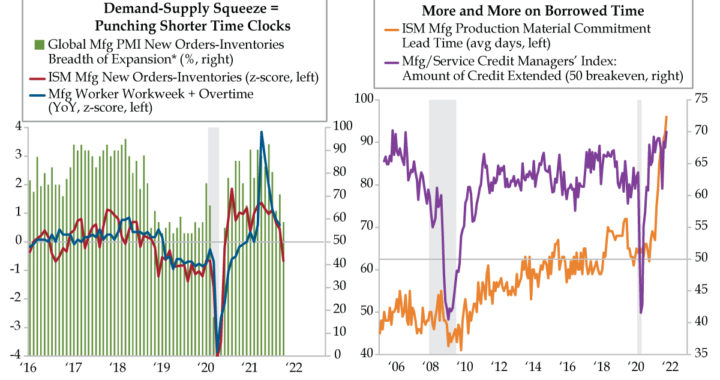

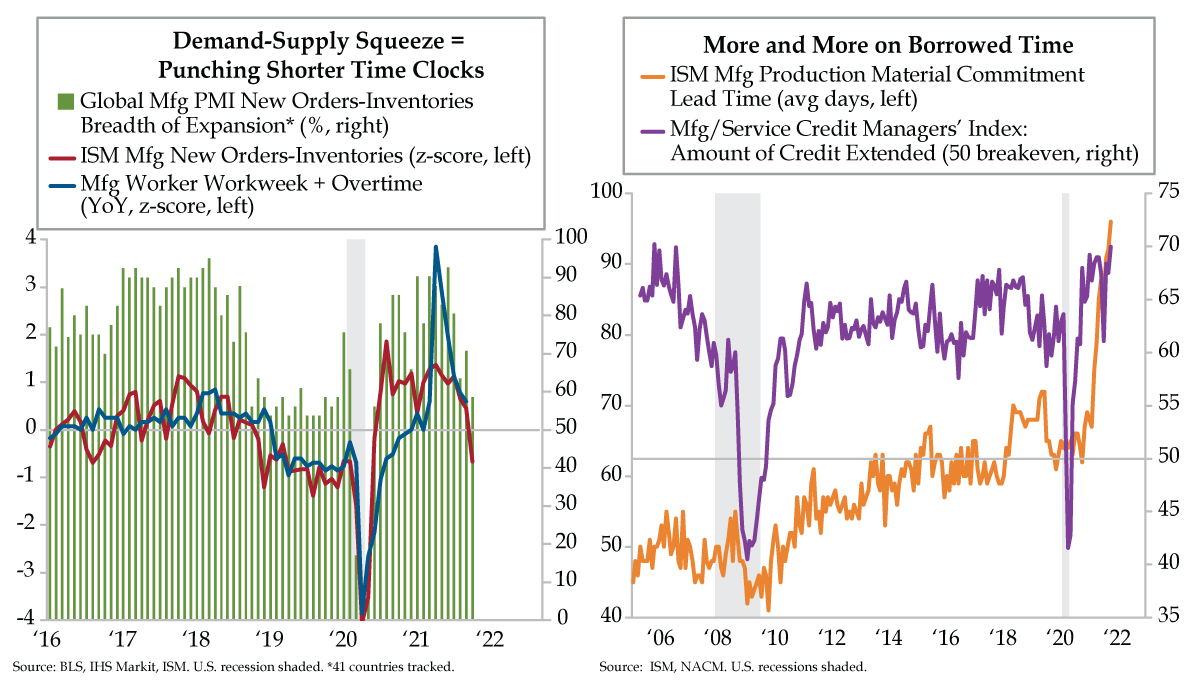

QI TAKEAWAY — The closely followed ISM New Orders-to-Inventories spread compressed sharply in October and points to reduced production shifts across the manufacturing complex. Lead times echoing the 1970s inflation era also mean a slowdown in the production process and higher leverage to manage through the environment. Favor companies with less exposure to the supply chain, especially non-cyclicals.

- The ISM New Orders-Inventories spread shrunk to 2.8 in October, the lowest since last year’s re-opening; as a z-score, this is below trend at -0.67, and mimics the rest of the world, with only 59% of major economies seeing spread expansions, the worst since June 2020

- The factory workweek plus overtime collapsed from 45.7 hours in February 2020 to a low of 41.3 hours in April amidst pandemic shutdowns; since recovering in January, performance has been up-and-down, before settling just below January’s print at 45.6 hours in September

- ISM’s lead time commitment for production material advanced to 96 days in October from September’s 92 days; higher upstream costs have manifested into a near-record level of credit extension, with the NACM’s Credit Managers’ Index registering a 70.0 print in October